Login

Login

Our Approach

We believe our results make us stand out.

We make investments in North American small and middle market buyout funds and equity co-investments. Having each spent most of their careers in this space, our senior investment team has extensive experience and a deep network of relationships.

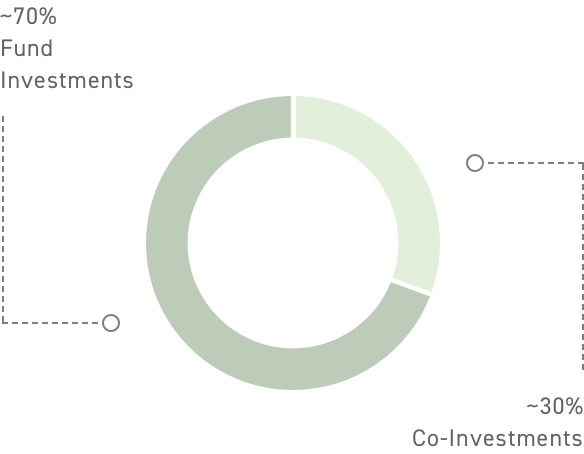

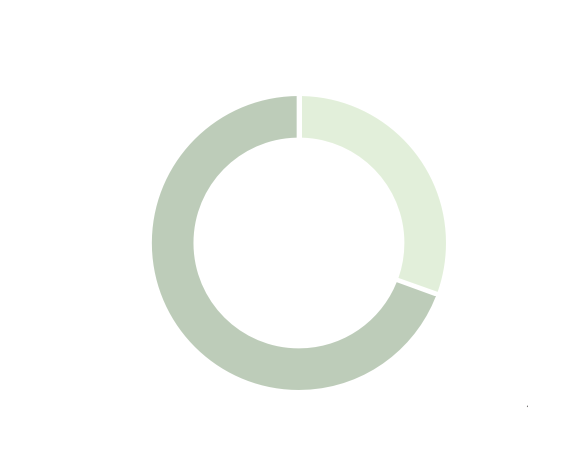

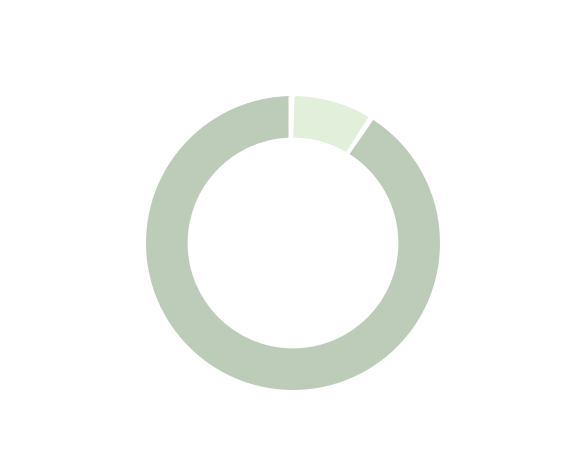

Fundamental to our investment philosophy is the combination of fund investments and equity co-investments. We believe augmenting fund investing with co-investing enhances our investment decisions and results.

research-focused and

relationship-driven approach

We seek to deploy rigorous and disciplined investment sourcing and selection, intentional portfolio construction, and prudent risk management, with an emphasis on long-term investing. We do this through a combination of fund investing and direct equity co-investing alongside the sponsors we back.

accomplished fund investors

We've built enduring relationships with established and emerging managers over decades in our market. Because we have maintained a singular focus on North American small and middle market private equity, we have developed deep expertise across strategies, sectors, and market cycles. We believe this approach helps us to identify the managers whose strategies, resources, and philosophies can deliver outperformance.

approach to co-investing

We take a targeted approach of exclusively co-investing alongside managers to whom we've made a primary fund commitment. We believe this approach drives inherently higher quality deal flow from pre-vetted sponsors with whom we often hold deep, longstanding relationships and who have a demonstrated track record of success with other similar investments.

Our team has worked to establish a reputation as a reliable and active co-investment partner, able to conduct due diligence quickly and add value at the Board level where possible.

The Twin Bridge platform encompasses three complementary strategies that are engineered to form a natural continuum and share a common focus on North American leveraged buyouts.

- Next-generation and established managers with an exceptional team and track record

- Focused on funds targeting $400 million or below

- Equity co-investments alongside our underwritten sponsors

- Portfolio companies with enterprise values generally below $100 million

- Multiple industries

- Primarily established fund managers with an exceptional team and track record

- Focused on funds over $400 million and generally less than $2.0 billion

- Equity co-investments alongside our underwritten sponsors

- Portfolio companies with enterprise values generally between $100 million – $500 million

- Multiple industries

- Established managers with whom Twin Bridge has a historical relationship

- Focused on funds targeting more than $2 billion

- Equity co-investments alongside our underwritten sponsors

- Portfolio companies with enterprise values generally between $400 million and $1 billion

- Multiple industries

At Twin Bridge, we seek to be a responsible and thoughtful investor and strive to maintain high ethical standards. We not only apply this philosophy to how we operate but also to the sponsors and management teams with which we form partnerships – because it is important to Twin Bridge, and because it is important to Twin Bridge's partners.

Risk management is fully integrated into our investment process. We apply a disciplined approach to diversification, balancing risk across strategies, sectors, time, geographies and environmental, social and governance factors while never compromising on manager or investment quality.

While we have a dedicated Chief Compliance Officer, it is the responsibility of every professional at Twin Bridge to monitor and enforce compliance best practices. We hold regular compliance trainings to ensure all employees are educated on applicable laws and regulations. In doing so, we take a team approach to protecting Twin Bridge’s own reputation and brand image in order to act as the guardian of our partners’ best interests.

We believe that efficient operations, delivered within an environment of control and transparency, are a critical part of the investment process. That is why we choose to manage these activities in-house – accounting, cash management, financial reporting, legal and regulatory compliance, portfolio analysis, and tax – in an effort to maintain the integrity and timeliness of our back-office operations.